If you are new to investing, our guide to the best ETFs could be a good starting point for you. Index funds are a form of mutual fund that’s passively managed and best suited for long-term investors. You can opt for a tax-advantaged account such as an individual retirement account (IRA), or a taxable brokerage account.

Exchange Traded Funds (ETFs)

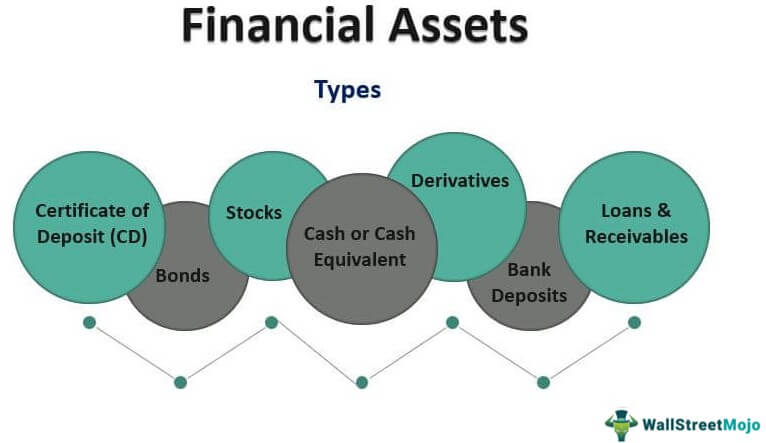

Current assets are short-term economic resources that are expected to be converted into cash or consumed within one year. Current assets can include cash and cash equivalents, accounts receivable, physical inventory, and various prepaid expenses. Stocks are often considered the riskiest financial assets, but they also offer the greatest potential for growth. Stocks represent ownership in a publicly traded company, which means when you buy a company’s stock, you become part owner of that business.

About Nature Portfolio

When interest rates fall, callable CDs are often called, and investors end up moving their money to potentially lower-income investments. The purest form of financial assets is cash and cash equivalents—checking accounts, savings accounts, and money market accounts. Liquid accounts are easily turned into funds for paying bills and covering financial emergencies or pressing demands.

Assets in Accounting and Business Operations

Hence, financial asset management is the building blocks of wealth and investment, and understanding them is fundamental to achieving one’s financial goals. Balancing the various asset classes in a portfolio is a strategic approach to secure financial well-being. Investors allocate their resources among these asset classes based on their financial goals, risk tolerance, and time horizon.

- Financial assets are more liquid than tangible assets, i.e. they can be turned into cash more rapidly.

- Alternatively, “preferred” shareholders have an additional layer of protection.

- For individual investors they can include such things as money market accounts and CDs.

- Financial instruments provide efficient flow and transfer of capital among the world’s investors.

Most assets are categorized as either real, financial, or intangible. Real assets are physical assets that draw their value from substances or properties, such as precious metals, land, real estate, and commodities like soybeans, wheat, oil, and iron. To measure symptoms of anxiety, we used the generalized anxiety disorder-7 (GAD-7), which is scored on a range of 0–21, and has a clinical threshold of 1044. Both measures have been clinically validated43,44, and are often used in primary care settings as screening tools ahead of formal diagnosis of depression and anxiety.

In corporate accounting, assets are reported on a company’s balance sheet and can be broadly categorized into current (or short-term) assets, fixed assets, financial assets, and intangible assets. Bank deposits are savings, fixed or current deposits which are maintained with financial institutions. It serves as the most common way to preserve your financial assets for safety assurance and interest-earning scope after a while. Moreover, the level of interest rate varies across the bank deposits.

For instance, an account holder of a money market account enjoys a comparatively higher rate of interest as compared to savings account holders. As a quick recap, short-term assets are those held for less than one year. These assets are typically meant to be converted into cash within a year and are considered liquid. For individual investors they can include such things as money market accounts and CDs.

They enable companies to finance short-term projects and tend to offer modest returns. Weighted, adjusted probabilities were taken from multivariable logistic regressions. In the past, there was a lack of clarity from regulators which previously held back financial institutions from involvement in digital assets.

Let us understand the advantages of financial assets list through the points below. It was found that out of 1000 households, at least two would invest in risk assets if there was a bank branch present within a 5 Km radius of their home. This study not only examines the availability of a bank but also the availability of information and support.

Loans and Receivables are those assets with fixed or determinable payments. For banks, loans are such assets as they sell them to other parties as their business. Let us understand the different types of assets about education tax credits in the financial assets list through the detailed explanation below. For deposit accounts, you sign an agreement with the financial institution and get monthly statements stating the value in the account.

Supplemental Table 3 shows the adjusted relationship between accrued financial assets and mental health using continuous definitions of the PHQ-9 and GAD-7 (and linear regression). A portfolio is composed of the various positions in stocks, bonds, and other assets held, and is viewed as one cohesive unit. The portfolio components, therefore, must work together to serve the investor’s financial goals, constrained by their risk tolerance and time horizon. Financial assets can generate income through dividends, interest payments, or rental income. Dividends are paid by companies to their shareholders, interest payments are received from bonds or fixed-income securities, and rental income can be earned from real estate investments. It represents the shareholder’s stake in a company and includes common stock, preferred stock, and warrants.